PWA : The Key to Digital Transformation in Insurance

Introduction

Digital transformation is the process of adoption and implementation of digital technology. As the name suggests, it is the process of transforming existing products, services, and operations using translating business processes into a digital format. Nowadays, the digital revolution is one of the most important determinants of economic development.

These days, everyone seems to be in the digital transformation process. When the Corona crisis changed life for everyone, the need for digital transformation became even more apparent as having more automated processes.

Digitalization: A game changer for the Insurance Industry

The digital transformation can be defined as a cultural, organizational, and operational change in the insurance organization through intelligent integration of digital technologies, processes, and competencies step-by-step in all functions and on each level through a strategic approach.

Digitalization is set to transform the insurance market, taking underwriting, customer service, and product innovation to the next level.

To the ultimate benefit of clients, digitalization will automate and speed up insurance processes, enhance transparency, and improve the quality and accuracy of data. With seamless data flows within the insurance ecosystem, the process of obtaining data should be almost instant.

The main stages of the value chain of the insurance company include the development of insurance products, marketing, sales and distribution, pricing and underwriting processes, insurance and claims administration, and risk management. Digitalization affects the entire value chain of the Insurance industry.

Drivers for Digitalisation

Several factors are combined to accelerate the digitalization of commercial insurance. The insurance industry is acutely aware of the need to address customer pain points, such as time-consuming and burdensome processes. It also recognizes the need to leverage the vast amount of accessible risk-relevant data to support companies navigating a fast-changing risk landscape.

Service Offerings & Benefits of Digitalisation

- Faster, accurate data processing:

To the ultimate benefit of clients, digitalization has automated and speeded up insurance processes, enhanced transparency, and improved the quality and accuracy of data. With seamless data flows within the insurance ecosystem, obtaining data should be almost instant. This will remove the need for back-and-forth, time-consuming interactions within the ecosystem and enable insurers to reduce error-prone or repetitive tasks.

- Overcoming the data challenges:

One of the primary goals is to fully digitalize data exchanges between insurers, clients, and brokers.

- Insights and innovation:

With better data flows, commercial insurers can generate insights using analytics and AI, which can be made available to clients quickly, understandably, and engagingly.

- Empowering people :

A big advantage of leveraging data is that it enables faster fact-based decision-making, empowering more informed decisions in underwriting, claims, and exposure management.

Progressive Web Apps – Key Technology in Digital Transformation

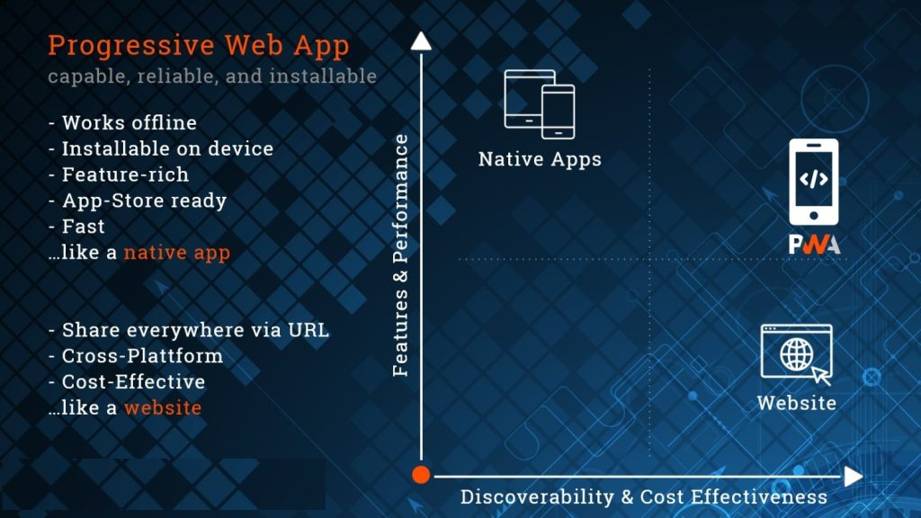

In today’s digital landscape, where every business constantly seeks ways to enhance their online presence and engage their customers effectively, the insurance industry is too behind in digitalizing the user experience. One powerful solution that has gained significant traction is the Progressive Web App (PWA). PWAs offer a unique combination of the best features of websites and native apps, providing businesses with numerous advantages such as improved user experience, cost-effectiveness, offline functionality, and lower bounce rates.

PWA thereby allows simpler user experiences with app-like interfaces & prevents the split of traffic between a native website and a mobile application.

“The PWA fills the gap between Web & Mobile by combining the best of these two worlds.”

PWAs are favored by users for their improved customer experiences. PWAs can help insurers with the following:

- Faster speed to market on new products

- Simpler generation of online quotes

- Easier claims processing, including accessibility when the user is off-line

- Deeper marketing insights unique to users arriving on the PWA, such as with telematics data

Why PWAs?

We are living in an era of mobile phones where our day begins & ends with mobile only.

In such an era of rapidly increasing mobile traffic, ignoring mobile users would be a complete loss of customer interest & hence, of businesses. PWA is a boon to cater to & engage such mobile users, offering a seamless mobile experience, and has proven to be a game-changer for businesses. Progressive Web Apps have witnessed continuous growth, with over 22,000 customer websites preferring them as of January 2023.

Below are the key reasons how insurance benefited out of PWA:

- App-like Experience

- Swift and Responsive Performance

- One App, Many Devices

- More Efficient Security

- Reliable and Work Offline

- Freedom from App Stores

- Easy to Install