OCR: Insurance Industry Digitalisation

Introduction

In this fast pace of digitalization where every other industry is chasing behind ways to get their work done accurately & quickly, OCR (Optical Character Recognition) has proved to be a boon to one of the most tedious jobs for data-intensive industries like insurance, banks, hospitals, etc. Just imagine having a system that is able to transform any piece of information whether audio, video, or image into computer-understandable language. This is what OCR does by digitalizing the documents. In this blog, we will walk through the usage & benefits of integrating OCR in the insurance industry where it has accelerated the document processing tasks, ultimately leading to cost savings and improved productivity with accuracy.

OCR: Insurance Industry Digitalisation

In data-intensive industries like insurance, OCR plays a vital role in achieving digital operation excellence and digital customer experience.

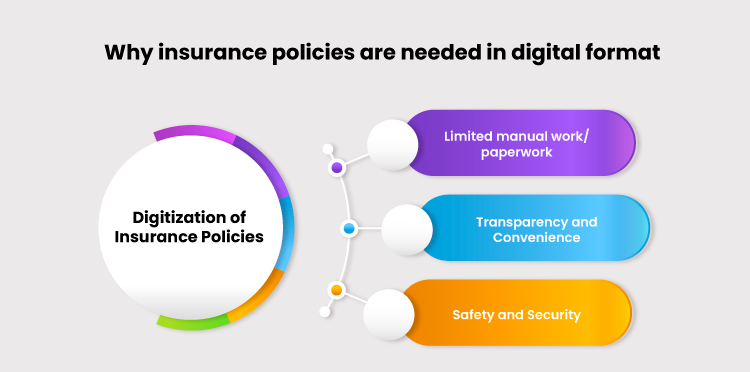

Why insurance policies are needed in digital format?

Digital Insurance

Advantages: Digitization of Insurance Policies

- Limited manual work/paperwork :

- Many insurance processes can be integrated by means of digitization. So, data verification gets easier and less time-consuming with this.

- This is especially true when an existing customer tries to renew the policy or buy a different policy from the same brand.

- The customer gets the required solution within a matter of a few seconds since the entire data is stored digitally and easily verifiable.

- There is no need to fill out too many forms or documents or give the same information that was given earlier.

- Transparency and Convenience: Transparency while making a claim is greatly increased when details and data are made available online.

- Data dashboards give a single unified view of the entire details of a customer.

- Customers can easily pay premiums, give any type of service request, or lodge complaints through the online portal.

- Safety and Security: Insurance policy data stored online is digitally safe and helps in quick policy reference.

- There is a lesser risk of losing the policies which are stored online.

- This system offers security from fraud instances as well.

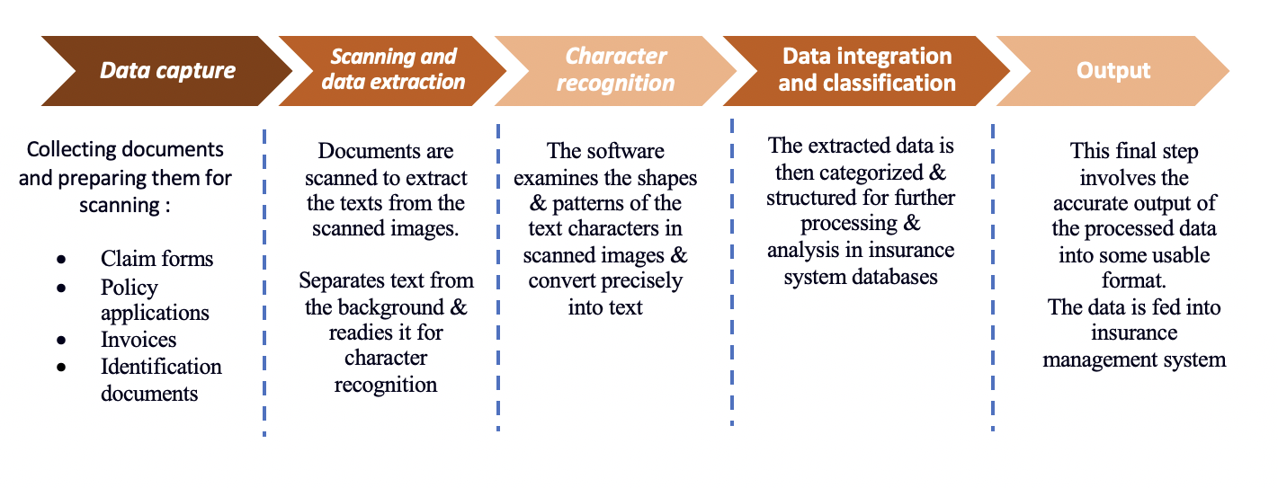

Steps: Functioning Of OCR In Insurance

There are Several key steps that go into the functioning of OCR in insurance. Here’s a detailed look at how OCR functions within insurance:

Key Steps of Functioning Of OCR in Insurance

Key applications of OCR in insurance

OCR technology extends to a wide range of functions in the insurance industry, each contributing to more efficiency and quality of service. Here are key areas in which OCR is making a significant contribution:

Claim Processing: Claims processing stands to be one of the critical functions of the insurance industry. Traditionally, this was one of the most labor-intensive processes, with enormous dependence on manual data entry- a time-consuming and error-prone process. OCR has made the entire process smoother and more efficient.

- OCR can extract data from claim forms and supporting documents, including medical reports, repair bills, and photographs effectively.

- Automating data extraction helped shrink the processing time and significantly increase the accuracy level of data.

- Insurers can, therefore, settle claims with much greater speed and precision. The customers benefit from faster claims resolution, which, in turn, adds to their overall experience.

Policy Administration: Policy administration involves a range of functions, such as data entry, policy document management, and renewals.

- OCR tech makes these functions easier and faster by automating the extraction and processing of data from various documents.

- For example, if an applicant sends a policy application, OCR can quickly digitize the information and feed it into the insurer’s database.

- This action helps in enhancing efficiency and also reduces administrative expenses.

- OCR can also handle large volumes of insurance policies flawlessly, making searching, retrieving, and updating information much easier.

Underwriting: Underwriting involves the assessment of risks and the determination of policy terms and prices.

- OCR will help underwriters by automatically extracting relevant information from application forms, medical records, and other supporting documents.

- OCR speeds up underwriting and ensures that underwriters have accurate and complete information for assessing risks.

This leads to quicker decisions and more accurate risk assessments, enabling insurers to offer competitive policies.

Fraud Detection: OCR can use data from various sources and detect inconsistencies or patterns that would otherwise hint at fraud.

- OCR can match data from different claims to detect duplicate submissions or discrepancies.

- OCR automates data analysis, enabling the insurer to detect and prevent fraud, consequently securing their financial health and operational integrity.

The Customers benefit from faster claims resolution, which, in turn, adds to their overall experience.

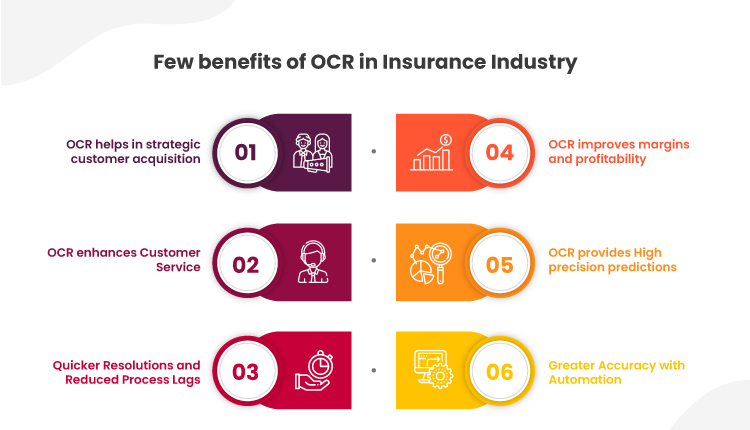

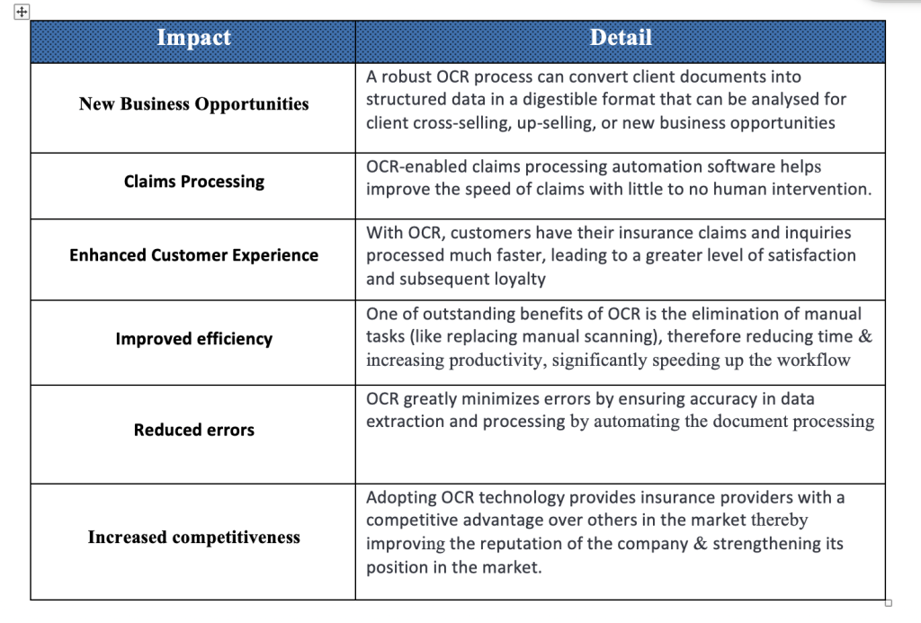

Benefits of OCR in Insurance :

Business Impact

Business Impact

Use cases of OCR in Insurance engagement within TO THE NEW:

OCR functionality has been implemented in the onboarding journey where ‘Additional Documents’ need to be uploaded based on UW requirements to reduce manual verification of each document by the Underwriting Team.

Briefly, OCR Scope includes:

- Document correctness :

Checking the correctness of the documents uploaded (Whether the uploaded document is correct or not? E.g.: If a PAN card needs to be uploaded and the user uploads an Aadhar card, then this is an ‘Incorrect Document’). If the document uploaded is incorrect, it prompts the user to upload the correct document.

- OCR Pass/Fail :

Whether the document is ‘OCR Pass’ or not? (This depicts whether the document has met the provided threshold percentage criteria)

- OCR Report:

To make a report of the OCR verified (‘Pass/Fail’) documents and send the same to a document repository, and also pass this information to the downstream system. The Report will include the compared field values, threshold values, % match, and failure reason if applicable. The Report needs to colour code the documents which are ‘OCR Fail’.

- In-Scope documents:

The documents for which the OCR has been implemented are: PAN card, Aadhar Card, Driving License, Voter ID, Passport, etc.

- Applicable for both B2B & B2C journey:

This OCR functionality will be in sync whether the document upload happens via the ‘Agent through the B2B application or via the Customer’s B2C journey.

Conclusion

As a takeaway of the entire blog, we can say that OCR is a technological breakthrough in the insurance industry by digitizing & automating the tedious job of document processing thereby saving both time and money in the entire process replacing manual scanning of paper documents in the conclusion section. Conclude your blog with a clear Call to Action, encouraging the reader to comment, share, or explore your website further. As the insurance sector continues to evolve, OCR will undoubtedly play a crucial role in driving innovation and maintaining competitiveness. Embracing OCR technology is not just a smart move—it’s an essential step towards a more efficient and customer-centric future.